Rates, Facts and Figures

This page provides information that may prove useful in preparing proposals for Federal and Non-Federal Sponsors. Office of Research Services are available to assist faculty during proposal development and submission.

1. Official Institution Name and Address

Georgetown University

Main Campus Office of Research Services

Box 571014 650 ICC

Washington, DC 20057-1014

2. Official Institution Business Officers

Melissa Layman, Director, Joint Office of Research Administration (JORA)

Tel: (202) 687-1664

Email: melissa.layman@georgetown.edu

3. Authorized University Proposal Signatories

- Blair Ribeiro, Senior Grants and Contracts Administrator

- Marie A. McElroy, Senior Grants and Contracts Administrator

- Ruel Hector Tiongson, Senior Grants and Contracts Administrator

- Jing Nie, Grants and Contracts Administrator

- John Dykes, Grants and Contracts Administrator

- Subramanian Chittur Srinivasan (Subu), Grants and Contracts Administrator

4. Fringe Benefits and Facilities & Administration (F&A) Rates

Georgetown University negotiates its fringe benefit rate annually and its facilities and administration (F&A) rate every three years with DHHS Division of Cost Allocation. The latest University’s Federally Negotiated Indirect Cost Rate Agreement (NICRA) dated January 30, 2023 and should be included in all federal grant and contract proposals.

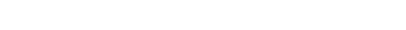

4a. Fringe Benefit Rates

The following fringe benefit rates are updated as per University’s Federally Negotiated Indirect Cost Rate Agreement (NICRA) dated January 30, 2022

Note 2: Fringe Benefit rates are negotiated annually with the cognizant federal agency and thus, cannot change until the next annual negotiations. Therefore, the current fringe benefit rates will continue to be governed by our current NICRA and will not be affected by a temporary situation such as COVID-19.

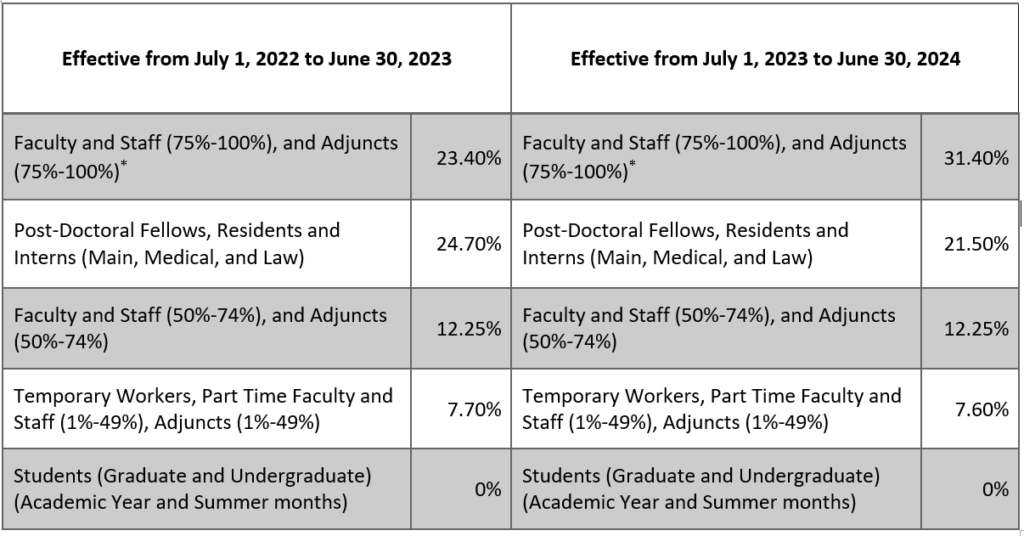

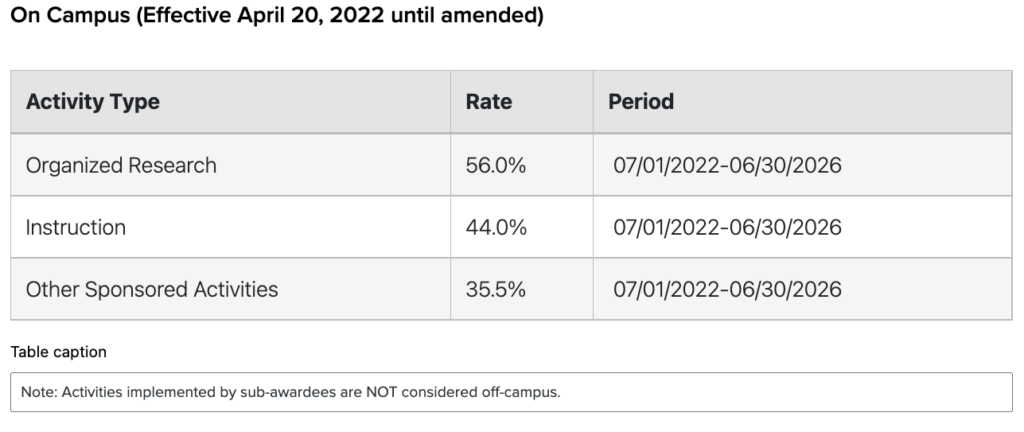

4b. Indirect Cost Rates

Indirect costs, otherwise known as Facilities and Administrative, or F&A, rates, are charged on most external research grants. The rates vary depending on the sponsor and other factors, as outlined below.

4-i. IDC on Federal Grants and Contracts

For proposals submitted to the National Endowment for the Humanities and the National Endowment for the Arts, and in accordance with NEH* and NEA guidelines respectively, the indirect cost (IDC) rate used will depend on the nature of the proposed work. For most proposals for fellowship and stipend awards, and when a zero rate is explicitly required, generally no IDC can be charged. In rare cases the negotiated Federal “Organized Research” rate might apply, but in general it is expected that for research and scholarship typical of the humanities, the “Other Sponsored Activities” IDC rate should be used. Because Georgetown has negotiated Federal rates, a de minimus rate is not applicable. Current negotiated Federal IDC rates can be found here.

* At the NEH link, navigate to Section 11. Budget Revisions, and scroll down to the text following item G for an explanation of allowable IDC rates.

4-ii. IDC on Non-Federal Grants and Contracts

- Pharmaceutical Agreements – 30%*

- Foundation and Corporation Agreements – 15%*

* When a sponsor has a published IDC rate, that rate will be adhered to. When the sponsor does not have a published rate, the University typically charges 30% for pharmaceutical agreements and 15% for foundation / other corporate agreements, although the University will accept the maximum rate that the sponsor is willing to allow. Please provide documentation for the IDC rate you are using as part of the proposal package in GU Pass.

4c. Exceptions for IDC Reduction

There are exceptions where an IDC reduction or waiver are considered. The PI must request a Vice-Provost of Research approval of this reduction/waiver by email. This approval must be included along with the proposal package routed for internal approval via GU Pass.

4d. Calculating IDC

Note that all IDC rates are charged on direct costs. Total costs include both direct and indirect costs, so the share of total costs that goes to indirects is not equal to the IDC rate. In general, if the IDC rate is r, the share of indirects in total costs is r/(1+r). For example, the current Organized Research IDC rate is 56%, so the share of indirects in total costs is 0.56/1.56 = 35.9% when this rate is applied. Similarly, the current Other Sponsored Activities IDC rate is 35.5%, so when this rate is applied, the share of indirects in total costs is 0.355/1.355 = 26.2%.

5a. On Federal Grant and Contracts

Calculate indirect cost by multiplying modified total direct cost by the appropriate indirect cost rate. Modified total direct cost is total direct cost minus the cost of the items below.

Alterations/Renovations to office or laboratory space

Equipment ($5,000 and over)

Patient care

Participant costs

Rental of off-campus facilities

Student tuition

Subawards (amount above the first $25,000 of each subaward)

Equipment is defined as an article of non-expendable tangible personal property having a useful life of more than two years, and an acquisition cost of $5,000 or more.

5b. On Non Federal Grants and Contracts

Calculate Indirect Cost by multiplying total direct cost by the appropriate indirect cost rate. No items are excluded from the Indirect Cost calculation for non-federal Grants and contracts.

6. Institutional ID Numbers

- Name: Georgetown University

- Business Address: 37th & O St. NW, Washington DC 20007

- Congressional District: DC-001

- CAGE Number: 0UVA6 (Expires April 17, 2028)

- DUNS Number: 04-951-5844 (expires April 4, 2022)

- UEI: TF2CMKY1HMX9 (replaces the DUNS Number effective April 4, 2022)

- IRS Employer Identification Number/TIN: 53-019-6603

- NSF Organization Code: 0014456000

- PHS Entity Number: 1-530196603-A1

- Unemployment Insurance I.D. Number: 82-0885

- CEC Number: 04-052-594B

- Postsecondary Education Data System (IPEDS): 131496

- Central Contractor Registration (CCR) TPIN Number: 1998C191469

- Registration SAM.gov (expires April 13, 2024)

- Number of employees: 10,322 (as of March 2023)

7. North American Industry Classification Codes (NAICS)

- 541690 – Other Scientific and Technical Consulting Services

- 541713 – Research and Development in Nanotechnology

- 541714 – Research and Development in Biotechnology (except Nanobiotechnology)

- 541715 – Research and Development in the Physical, Engineering, and Life Sciences (except Nanotechnology and Biotechnology)

- 541720 – Research and Development in the Social Sciences and Humanities

- 611310 – Colleges, Universities and Professional Schools

- 621512 – Diagnostic Imaging Centers

8. Assurance and Compliance Numbers

Federal-Wide Assurance ID (FWA #): FWA00001080; February 2020

DHHS Cost Sharing Agmt. Date: December 7, 1984

PHS Animal Welfare Assurance Number: A3282-01

Misconduct in Science Latest Annual Report Date: January 25, 1994

FICE number: 001445

9. Cognizant Audit Agency (Current)

Director, Non-Federal Audits

Office of Inspector General

U.S. Department of Education

Wanamaker Building

100 Penn Square East, Suite 502

Philadelphia, PA 19107

Phone: (215) 656-6900

10. Cognizant Federal Agency

Department of Health and Human Services- DHHS

Mr. Darryl W. Mayes -Deputy Director Cost Allocation Services

Phone: (301) 492-485

11. Disclosure Statement Filing Information

U.S. Department of Health & Human Services

Mr. Arif Karim

Branch Chief–Colleges & Universities, Hospitals and Nonprofit Organizations

Cohen Building, Room 1067

330 Independence Avenue, SW

Washington, DC 20201

Date Disclosure Statement was filed: 03/12/2015

12. NIH Salary Cap

For additional information, please refer to the new Guidance on Salary Limitation for Grants and Cooperative Agreements from March 01, 2023 NOT-OD-22-076

13. Graduate Stipends Guidelines

Please visit Georgetown University Guidelines for Graduate Stipends

Please visit Georgetown Alliance of Graduate Employees (GAGE) the graduate union at Georgetown University in Washington, DC for additional information.

14. Cost Accounting Standards Board Disclosure Statement (CASB DS-2)

The University’s DS-2 disclosure statement regarding its cost accounting standards can be accessed at the Sponsored Programs Financial Operations.

15. University Tax Documents

The Tax Department has the most up-to-date list of all University-related tax documents, many that are already available for download.

For the Form 990 please access the latest form report via this portal.

17. Other useful links

- Key Facts Georgetown University

- Code of Ethical Conduct

- Charter of the University

- Georgetown University Policies

- Governance Documents

- Financial Statements

- Uniform Guidance Audit Reports

- Financial Reports, Disclosures, and Plans

- Tax documents

- Sponsor Accounting Policies

- IDC Policy for RICIs

- OCFO Policies

- Retention and Destruction Policy

- HR Policies

- Procurement Policies

- Financial Conflict of Interest Policy

Contact Us

Office of Research Services

37th & O Street NW Box 571014 650 ICC

M-F, 8:30am – 5:00pm

Phone: (202) 687-1958 – Email: researchadmin@georgetown.edu

Last updated on May 4, 2023